Evolution II Fund reaches final close at USD216 million.

Inspired Evolution has successfully secured a further USD87.75 million in commitments from CDC Group Plc, Cyane Holdings Ltd, European Investment Bank, KLP Norfund Investments AS, Morgan Stanley Alternative Investment Partners and a US healthcare system to reach total capital commitments of USD216 million at final closing of its Evolution II Fund.

Co-Managing Partner, Wayne Keast, said “We are pleased to have secured commitments from 12 leading investors comprising of a mix of strategic international DFIs, specialised fund-of-funds, institutional investors, pension funds and family offices”. Mr Keast added “growing investor confidence in Inspired Evolution’s offering, consolidates its market position as one of Sub-Saharan Africa’s leading specialised clean energy and resource efficiency investment advisory businesses”.

Setor Lassey, a Director in CDC’s Funds and Capital Partnerships team covering Africa noted, “Investing in clean energy is a key priority for CDC and investing in Evolution II Fund will increase access to rewewable energy across Sub-Saharan Africa, helping to tackle climate change. We look forward to a collaborative and productive partnership.”

“Access to reliable energy is a prerequisite for economic development. This investment is expected to contribute towards improved energy access and reduced carbon emissions across Sub-Saharan Africa. We are pleased to have mobilized institutional capital from KLP (Norway’s largest pension fund) to co-commit USD29 million into Evolution II,” said Mark Davis, EVP Clean Energy at Norfund.

“Climate positive solutions and energy access are key pillars of our impact strategy and our investment in Inspired Evolution – a team we have known since 2011 – underscores our commitment to deploy capital to deliver commercial returns and tangible, sustainable impact,“ said Vikram Raju, Head of Impact, AIP Private Markets, Morgan Stanley.

“We welcome our new investor partners onboard the Inspired Evolution platform. We are delighted with this additional support and recognition given by the market to Inspired Evolution. These final commitments are testament to the successful demonstration of our investment thesis and performance having achieved top-quartile returns under our first Evolution One Fund,” said Christopher Clarke, Co-Managing Partner at Inspired Evolution.

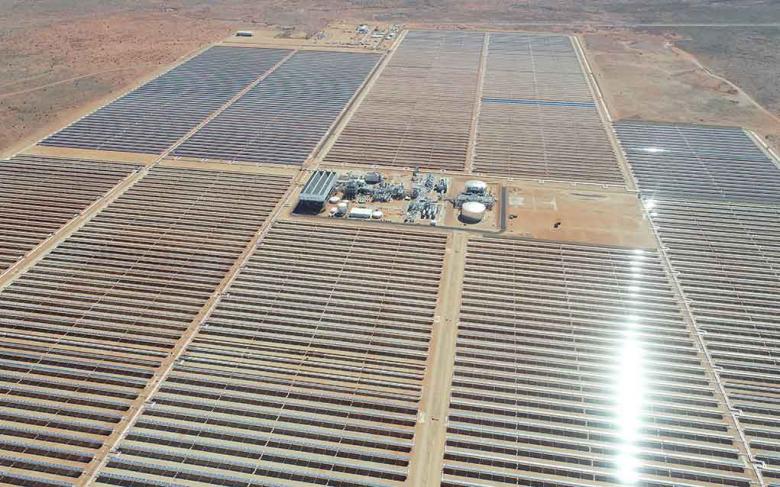

The Inspired Evolution platform was established in 2007 by Christopher Clarke and Wayne Keast who raised USD90 million for Evolution One Fund in 2008. Evolution One made 12 investments and has developed and sold more than 922 MWs of clean energy projects. Both funds are specialised clean energy infrastructure and resource efficiency growth funds, currently active across 11 Sub-Saharan African countries. The funds invest in affordable, least-cost, low-carbon clean energy infrastructure projects and promote growth in resource efficiency technologies, products and businesses. Inspired Evolution’s measurable development impacts, which to date have achieved 23 times investment multiple for every US dollar invested, will improve energy access and reduce industry footprint, contributing to a brighter future for Sub-Saharan Africa’s people. Since inception, the Inspired Evolution platform has achieved 17 exits.

Evolution II Fund’s investors include the African Development Bank, CDC Group, Cyane Holdings Ltd, European Investment Bank, the Dutch Development Bank FMO, the Finnish Fund for Industrial Cooperation, the European Initiative on Clean, Renewable Energy, Energy Efficiency and Climate Change related to Development SICAV, SIF – Compartment Global Renewable Energy and Energy Efficiency Fund, Swedfund International AG, KLP Norfund Investments AS, Morgan Stanley Alternative Investment Partners, Swiss Investment Fund for Emerging Markets managed by Obviam and a US healthcare system. For more information, please visit www.inspiredevolution.co.za.